Consumers and would-be clients don’t know what they don’t know.

This is one of the clear barriers to persuading more people to seek advice. Our latest advice gap research shows that those who work with an advice professional know the value of doing so – they’ve experienced it for themselves.

But how can the profession reach those who not only don’t know what they’re missing, but have no frame of reference for what to expect from advice, or what good value looks like?

In the 2025 edition of The Advice Gap report, we examine what consumers are saying about the value of advice (both those who’ve paid for it and those that haven’t), as well as explore different perspectives on value from practitioners themselves.

How much does advice cost anyway?

As part of our latest consumer research into the advice gap, carried out in partnership with YouGov, we tested consumer understanding about how much you need to access advice, how much it costs and what you get for your money.

Just over half of consumers we heard from said they had no idea about the level of assets needed to access various advice and support services, whether that was general guidance about money matters, personalised financial planning or wealth management.

The amount people were prepared to pay for these services was also quite different to the reality. For example, only 5% of respondents said they would be willing to pay more than £500 for wealth management advice.

If people don’t understand what advice can do for them, then it makes sense they are not prepared to pay much for it. It’s hard to decide something is of value if you don’t know the cost or what you’re getting in return.

Yet for those that have taken the leap, the stats are hugely positive: among those respondents who have paid for advice, a massive 91% say they found it helpful, up 5% from 2024.

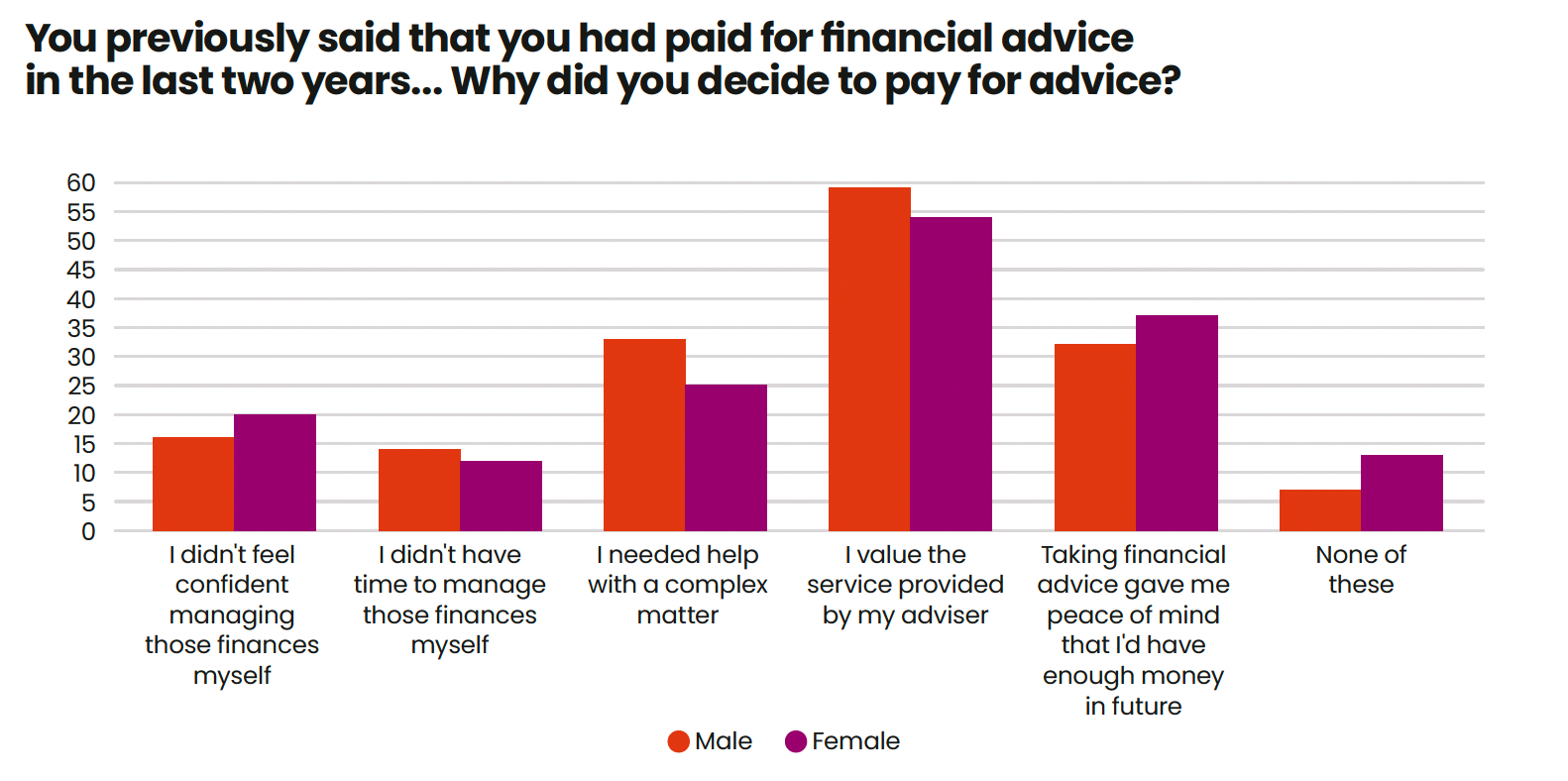

When we asked people who’d paid for advice in the past two years why they did so, over half of respondents said it was because they value the service provided by their adviser. Peace of mind about the future also featured strongly.

The perspective from advice pros

Advice professionals we spoke to echoed our findings on the value of advice, both in terms of consumer understanding and the demand for advice:

“In my opinion, the issue isn’t so much a lack of advisers – the so-called ‘adviser gap’ – but more a disconnect between the value of advice and the willingness or ability of clients to pay for it.”

“There are plenty of qualified, capable advisers across the UK. The real challenge is many clients either don’t fully understand the value of advice, or they simply don’t want (or feel able) to pay for it, especially when it’s not packaged in a way that feels accessible or cost-effective. The industry often focuses on supply, but the real issue is demand more specifically, the perceived cost versus benefit from the client’s point of view.”

Advisers and planners know the value they are delivering to their clients, and see how they are making a difference to clients’ financial futures, whether when taking on a new client or through their long-term client relationships.

Under Consumer Duty, they are also expected to demonstrate this value, and that they are providing ‘fair value’ for their target market. This has led to some firms choosing to serve a narrower set of clients. In 2025, 50% of adviser respondents said they had stopped serving clients as a result of Consumer Duty, a trend we first identified in 2024.

The focus on making sure value is being delivered is an important regulatory priority. But, like the RDR before it, Consumer Duty is leading to unintended consequences for the number of people that can access advice.

Championing advice and its value

We also know from separate research that it can be hard for firms to ‘measure the unmeasurable’ when it comes to evidencing the value of advice.

Last year, Royal London published The Meaning of Value report, with the lang cat and Opinium as research partners.

The report found that consumers looking for an adviser are doing so because they value their skills and knowledge. Yet those who have experienced advice place more emphasis on the emotional and psychological benefits of advice.

Anecdotally, we heard how many clients find their way to advice due to a specific financial need, but over time find the benefits go much wider, and they find themselves pleasantly surprised by the all-round nature of financial planning that goes beyond money and assets.

Advice firms and planning practices are businesses like any other. It is rightly for them to decide who best to serve.

Yet the messaging challenge remains: for people to better understand the value advice delivers, it’s about addressing consumers’ perception of value, rather than pure cost.

Greater clarity on the services available, and the costs, could be one way to clue consumers in to what they don’t know. A greater understanding of the value of the advice should flow from there. And if they go on to work with an advice professional, that sense of value will only build and grow.