The recent announcements by both the FCA and HM Treasury have propelled targeted support to the top of the regulatory agenda.

With chancellor Rachel Reeves mentioning it as part of her Mansion House speech in July, it is clear there is some hefty political weight behind the initiative.

There are still a few stages to complete before this becomes a reality, most notably legislation and the final FCA rules. But make no mistake: this is happening, and as a result advisers will need to rethink the relationship they have with their clients and providers.

For those of you who have better things to do than read FCA and/or Treasury papers, here is a quick reminder of what we are actually talking about.

Using the Treasury’s own words, targeted support will enable authorised firms to provide more support with investments and pensions, making recommendations that are designed for groups of consumers with similar characteristics and circumstances.

This will help, in particular:

- Consumers under-saving for retirement Currently, firms can warn a consumer they may be under-saving for retirement. Under targeted support, a firm will be able to suggest an alternative pension contribution rate.

- Consumers struggling with pension access decisions Currently, firms can provide a consumer with factual information around their options. For example, explaining the key features of an annuity or drawdown. Under targeted support, a firm could help people navigate their options by suggesting a course of action, for example, a specific drawdown product.

- New investors Under targeted support, a firm will be able to help those with substantial savings to consider investing and suggest an appropriate investment product.

Cutting to the chase, the first two developments feel hugely positive.

There has long been a weird information asymmetry where providers can see consumers self-harming, or can know the answer to the question being posed, but are unable to support them or suggest an improved outcome without straying into advice.

Targeted support will allow providers to respond more effectively to customer enquiries, and proactively nudge them into actions that should lead to better outcomes.

The customer will need to be made aware that these are not personalised recommendations, and if that is what they require, they should seek advice.

For these support scenarios there is the potential for a clear win-win, benefiting both the advice profession and consumers.

However, while the first two scenarios above are about supporting consumers, the last one is about sales. This changes the nature of the service being offered.

The provider is not supporting existing customers they have acquired (and are earning revenue from), they are trying to convince someone to become a customer.

These services are likely to be free and, as everyone knows, if something is free, you are the product.

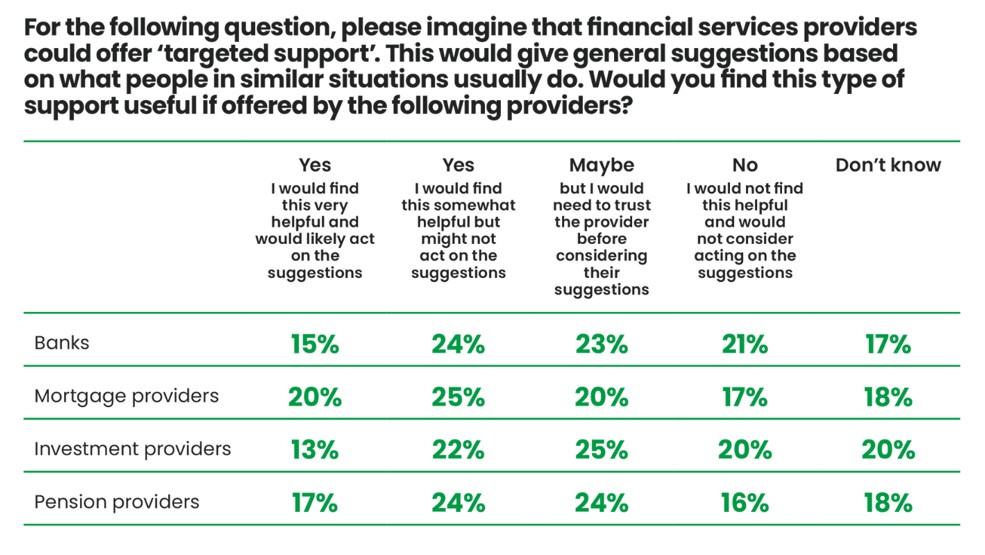

As part of our latest advice gap research, we asked consumers whether they thought targeted support would be something they would welcome.

The good news is it was seen as potentially helpful by 41% of respondents when offered by a pension provider, 39% when provided by a bank and 35% when delivered by an investment firm.

The not-so-good news is almost a quarter of consumers (24% for pension providers and 25% for investment firms) say they would only act upon the suggestions if they felt they could trust the provider in question.

Brand reputation and trust are going to be critical factors here.

For advisers, these changes should be seen as a positive.

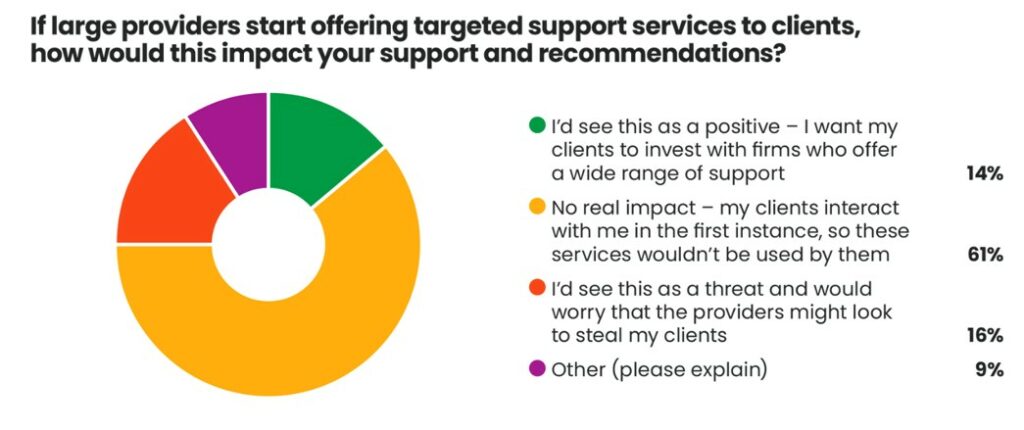

Most advisers tend to own the client relationship and are first point of contact if/when the client needs any sort of support.

Our advice gap research also shows how much consumers value this sort of relationship, with 91% of those who have paid for advice in the past two years saying it was helpful or very helpful.

However, there might still be instances where the customer will contact the provider themselves, or the provider chooses to initiate the conversation.

In these scenarios providers need to be very careful to support the adviser/client relationship by being transparent about the nature of the service, making sure consumers understand they are not receiving tailored advice.

Some 16% of adviser respondents in our advice gap research said there was a risk providers might be seen to be “stealing our clients”.

For providers operating in this space it will be vital to ensure advisers are aware of these services as and when they are brought to market.

With the political weight behind this initiative there is little doubt these targeted support services will start to come to market during 2026.

Advisers have little to fear, and with providers required to signpost customers towards personalised advice where required, these services should actually be a net positive for the advice sector.

However, as these services become more commonplace, advisers should start factoring them into their provider research and selection processes.

Providers who are implementing targeted support well and delivering improved customer outcomes while engaging advisers along the way deserve to be rewarded with the support of the advice profession.

And those who don’t, don’t.

Mike Barrett is consulting director at the lang cat

—

This article first appeared on FT Adviser in August 2025