Two years ago, the Consumer Duty was implemented with the aim of setting higher and clearer standards of conduct for all firms, resulting in improved outcomes for retail customers.

Fast forward to 2025 and there is already evidence that these objectives are being achieved.

However, as the lang cat’s Advice Gap research shows, the accidental advice gap is growing ever wider, largely due to the challenge of offering fair value to lower-value clients.

Starting with the positives, consumer research shows the perception of financial services and the outcomes being received are improving. Outside of financial planning and investing, YouGov research conducted earlier this year shows an across-the-board improvement in public opinion of banks and how they are performing. And in our core markets of financial advice the results from the Advice Gap research are even more positive, with a massive 91% who have paid for advice saying they found it helpful, up 5% from 2024.

However, the same research has identified a cohort of consumers for whom Consumer Duty has not been such a positive experience.

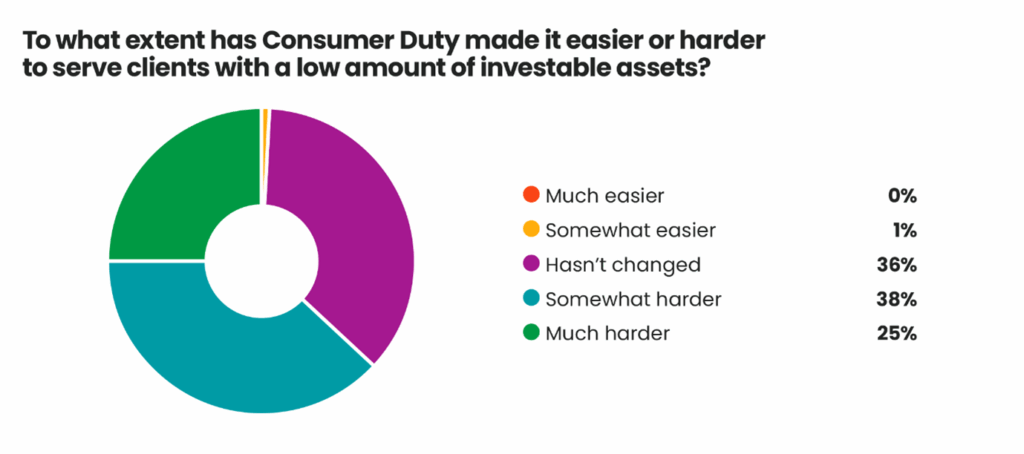

Half of adviser respondents in the survey say they have stopped serving clients as a result of Consumer Duty, with the average age of these clients being 54. On average these ‘accidental advice gap’ clients represent 11% of a firm’s overall client bank. Smaller firms (those in the £50m-£100m bracket) report a greater proportion, rising to 17%. And almost two-thirds of advisers believe the regulation has made it much harder to profitably service clients with low amounts of investable assets.

At Just Group we can help both advice firms and their lower-value clients overcome these challenges. We can relieve some of the pressure of adhering to new regulatory requirements, while also helping advice firms run their business more efficiently – particularly where lower-value clients’ needs can be tricky as they move from accumulation to decumulation.

Advice firms can refer these clients to Just’s Destination Retirement services. Our purpose-built digital service platform, with specialist human support, delivers high-quality retirement guidance and advice to all value profiles, wherever they are on their journey to and through retirement. We remunerate advice firms for completed referrals, while freeing up their time to serve higher-value clients.

Rob Hudson is managing director, digital wealth at Just Group

—

For more information, please email [email protected].