Measuring and tracking data over time is a Good Thing (as any research firm will tell you).

It allows you to track progress (or the lack of it), identify trends and base decisions on what’s actually happening, as well as forecast future behaviour.

10 years on from Citizens Advice’s initial analysis of the advice gap, the problem remains as intractable as ever.

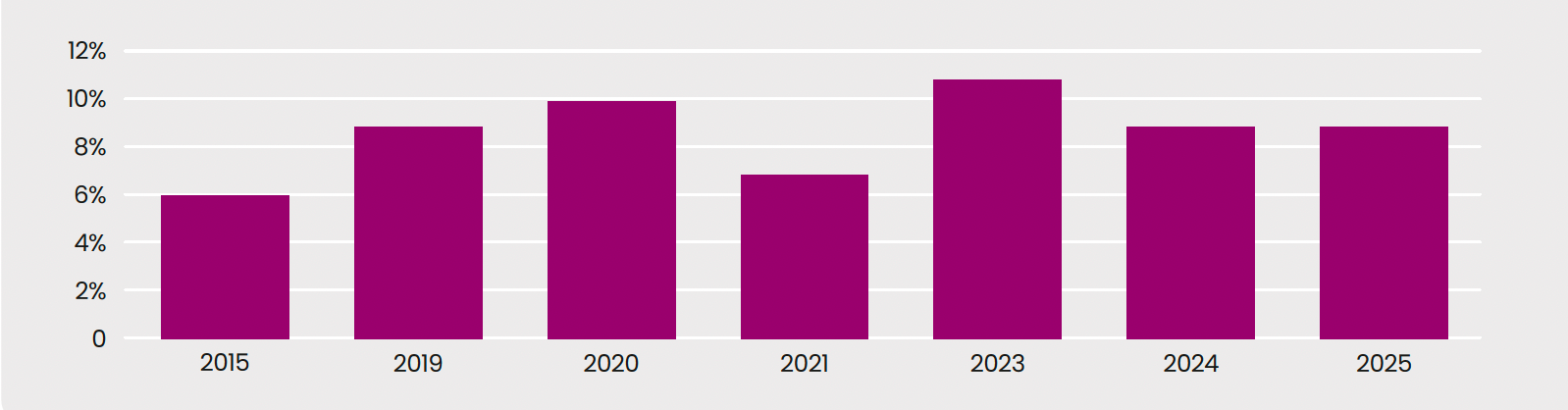

The lang cat picked up the research mantle in 2019, and we have been evolving the study since then. This is because we want to better understand not only the causes of the advice gap, but if there are viable ways to get advice and financial support to those outside of the 9% that currently pay for it.

Looking back over that time, it is interesting to see the factors at play, and what these tell us about where the opportunities to help narrow the advice gap may lie.

The advice gap origin story

When Citizens Advice first explored the advice gap issue in 2015, the regulatory backdrop was different. We were a few years into the RDR, we had the Money Advice Service (now part of MoneyHelper), and the Financial Advice Market Review (FAMR) was underway.

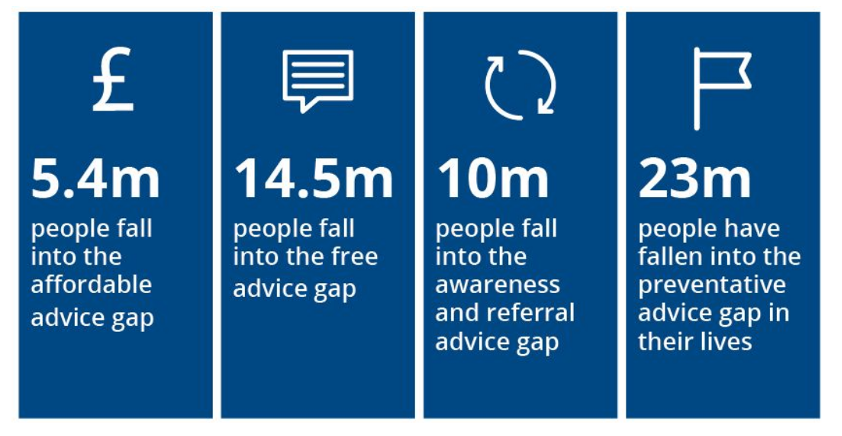

Citizens Advice argued there wasn’t a single advice gap, but a series of gaps which prevented people from seeking and benefiting from advice:

- The affordable advice gap: Consumers who are willing to pay for advice but not at current prices.

- The free advice gap: People who want advice but are unable to pay for it.

- The awareness and referral gap: People who are not aware that advice exists, or where to get that advice.

- The preventative advice gap: Those who would benefit from having money advice as a preventative measure.

Based on a YouGov survey of over 2,000 adults, Citizens Advice estimated that:

How the advice gap has changed over time

2015 is an interesting starting point from which to track the advice gap in that it was the year the pension freedoms reforms were introduced.

With more choice and flexibility around how to take retirement income came more complexity, and so the demand for advice increased.

In 2020 the research was carried out prior to the Covid lockdown, but we saw the impact of the pandemic in 2021’s figures, where the proportion of people paying for advice fell from 10% to 7%.

By 2023, the outlook on advice take-up was more positive, with 11% paying for advice. But this positivity was short-lived, with the proportion falling to 9% in 2024 in the wake of Consumer Duty and advice firms choosing to serve a narrower target market. That proportion has remained stubbornly at 9% in this year’s study.

What could move the dial?

One advice professional we spoke to hit the nail on the head when they talked about the “levers” that can be pulled to tackle the advice gap: regulation, tech and people.

On the first of these, the wider financial services industry is braced to see how the FCA’s advice guidance boundary review, and in particular, the targeted support proposals, will play out. Will this result in getting more financial help to more people, or does it actually risk poor client outcomes?

On tech, this is a fast-paced environment with new tools coming to market all the time. Many are focused on making advice and planning processes more efficient, as well as client engagement and fixing the sluggish industry processes that get in the way of good advice.

Finally, on people and recruitment: our latest adviser research found that while 20% of respondents believe recruitment is a significant problem for their own firm, 44% say it is one for the wider sector.

As we continue to track the proportion of those paying for advice, it would be a huge win if that 9% became a more substantial figure on a consistent basis. After all, a problem that isn’t getting any smaller is still a problem.