The Advice Gap report, powered by the lang cat, is the definitive study into the access to and take-up of financial advice in the UK.

It blends consumer research, conducted with YouGov, with insights from professionals on the lang cat’s over 1,600-strong advice panel.

While we are now 10 years on from the original study carried out by Citizens Advice, sadly the gap shows no sign of narrowing. The Advice Gap 2025 shows the proportion of the UK population paying for advice has flatlined – hardly a measure of success.

So what are the causes? And crucially what, if anything, can be done to address the advice gap once and for all?

What is the advice gap?

Broadly, we define the advice gap as the difference between those who have and have not paid for advice in the past two years. This includes those who have paid for mortgage advice.

The 2025 Advice Gap research found that only 9% of the UK population have paid for advice, echoing the results from 2024 and down from 11% in 2023.

9%

of consumers have paid for

financial advice in the last two years

Demand for advice rose in the wake of the pension freedom reforms in 2015, as decision-making around retirement planning became more complex. We then saw a drop in the number of people paying for advice in 2021, the first available point to measure the impact of the Covid pandemic, and a further slight drop in 2024, which we attributed to the changes advice firms were making to their business models as a result of Consumer Duty.

But the best summing up of the advice gap issue comes from a member of our advice panel:

“It seems there are a significant number of people who need advice and would benefit from it, whether that’s financially or from the peace of mind that advice brings.

“But they can’t access it because it either costs too much, or the services they need are just not profitable at those levels for companies. Finding a solution would not only help those people but open up a huge untapped client list.”

It’s important to understand the advice gap from both sides of the divide – the reasons why the 91% are not paying for advice, and just how much advice is valued by the 9% that do choose to pay for it.

Latest Analysis

The likely knock-on impacts of targeted support

Targeted support services should be net positive for the advice sector. But for consumers, the picture is more nuanced.

The accidental advice gap – and what to do about it

In the wake of Consumer Duty, the accidental advice gap is growing ever wider, largely due to the challenge of offering fair value to lower-value clients.

Behind the advice gap

- what are the causes?

Looking at the causes of the advice gap, we can see from both the consumer and adviser research that there are various factors at play.

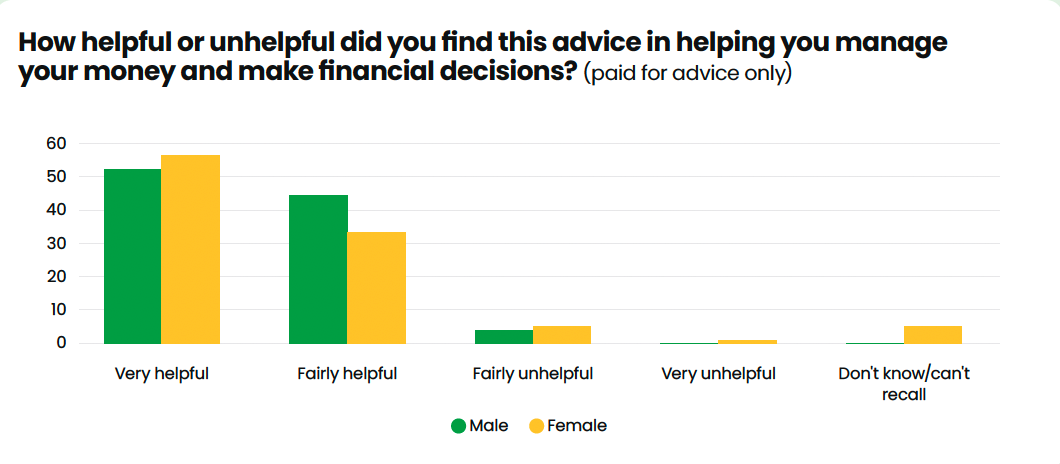

On the consumer side, the lack of trust in advisers among those who haven’t received advice remains a significant barrier. Yet for those who have paid for advice, the value of the service comes through loud and clear.

Consumer research

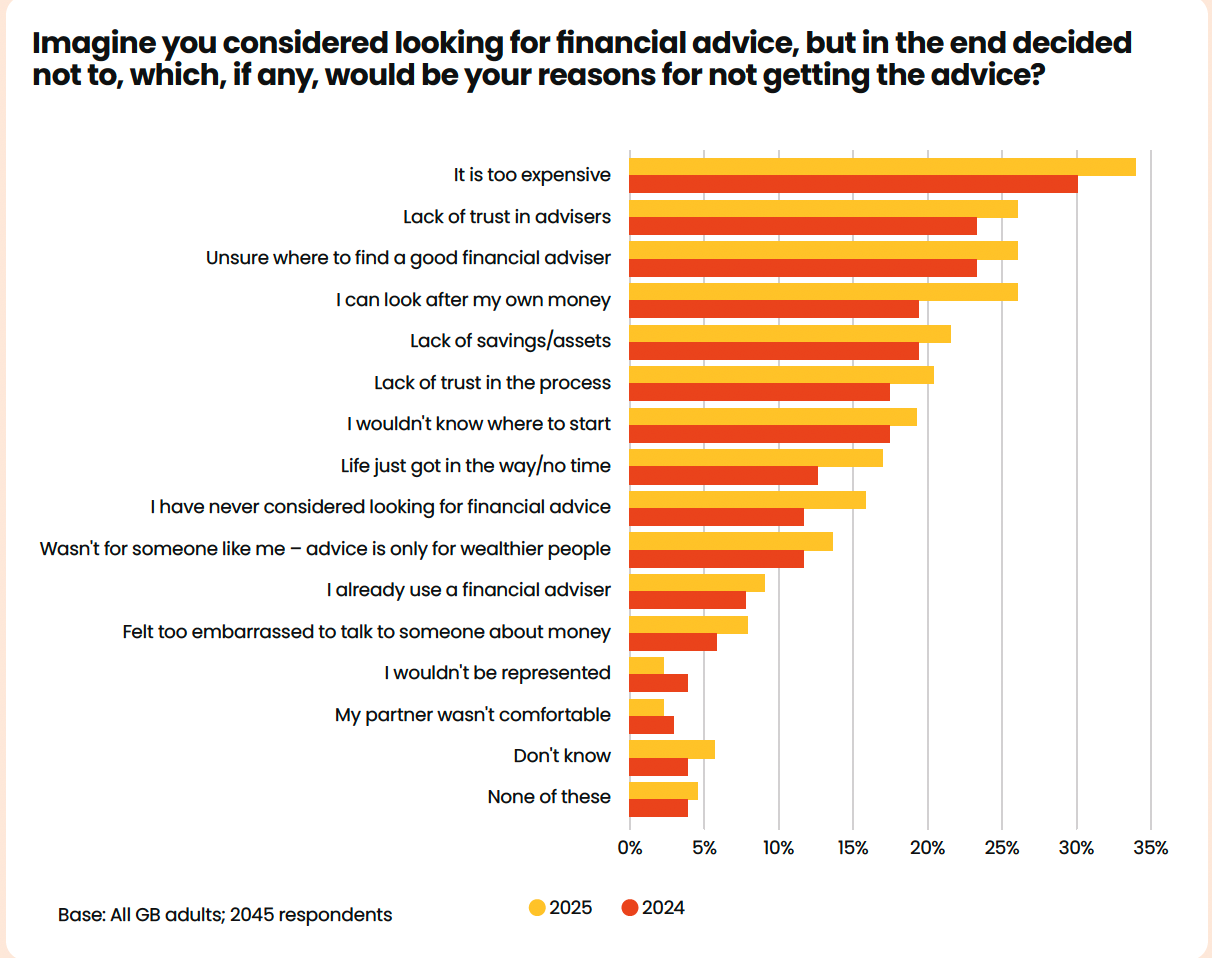

Consumers cite the cost of advice and not knowing where to find a good adviser as some of the other reasons why they’d decide against getting financial advice.

Just under a third of respondents say they would never pay for advice. But for the remainder it’s about affordability, trust and value. If they could be persuaded to trust and value advice, they’d be more likely to pay for it.

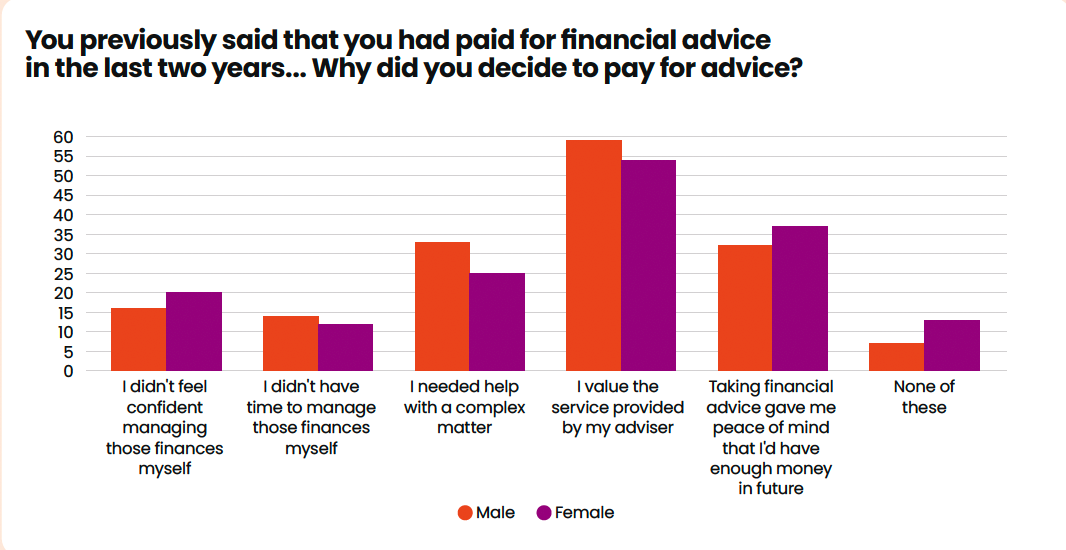

Over half of consumers we heard from who have paid for advice in the past two years say they value the service and ongoing relationship they have with their adviser. Some say they sought advice to get help and support with a complex matter, while for others advice was about gaining the reassurance and peace of mind that they had ‘enough’ money for their future.

Adviser research

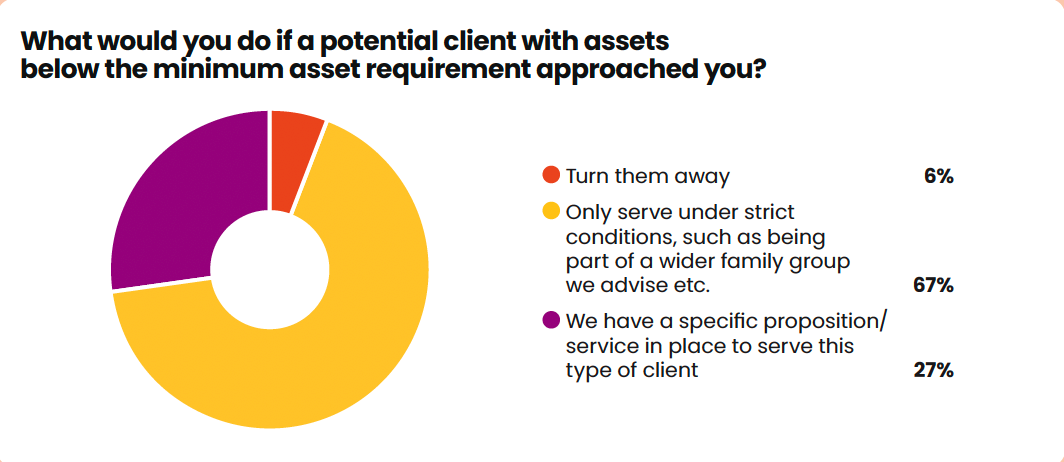

Just under two-thirds of advice firm respondents have a minimum asset requirement for clients. On a mode average basis this comes out at £100k, and on a mean average value at £276k.

For those who don’t meet the stated minimums, most firms we heard from either have a specific proposition in place or will attempt to help where they can.

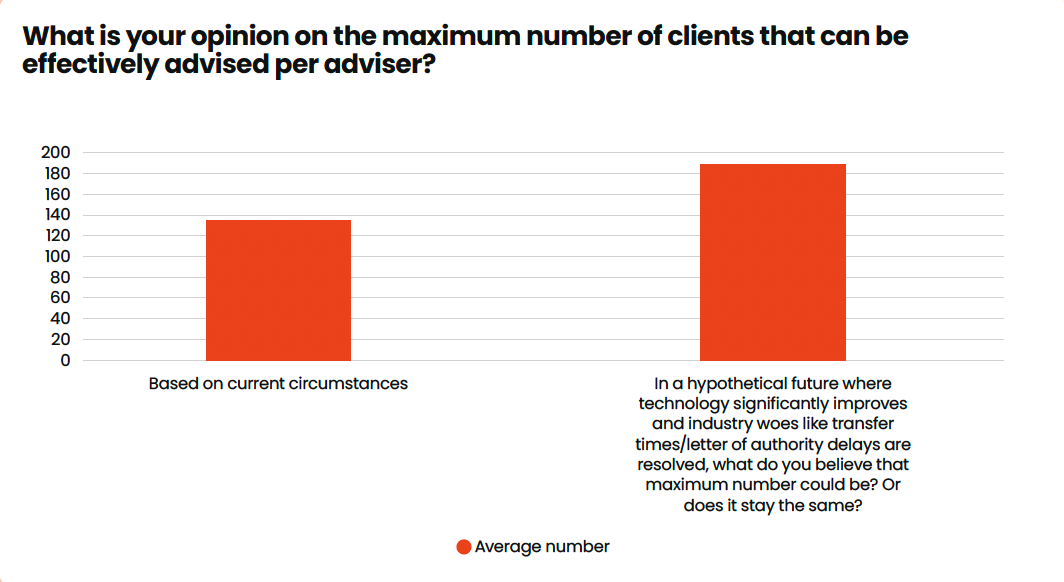

We also explore the issue of capacity to deliver advice, and how might this capacity increase if systemic industry issues were addressed.

Advice professionals believe a further 38% capacity could be unlocked if the regulatory landscape were made easier, if tech were to improve and things like transfer delays and poor service were resolved.

Addressing the advice gap

increasing the availability and adoption of advice

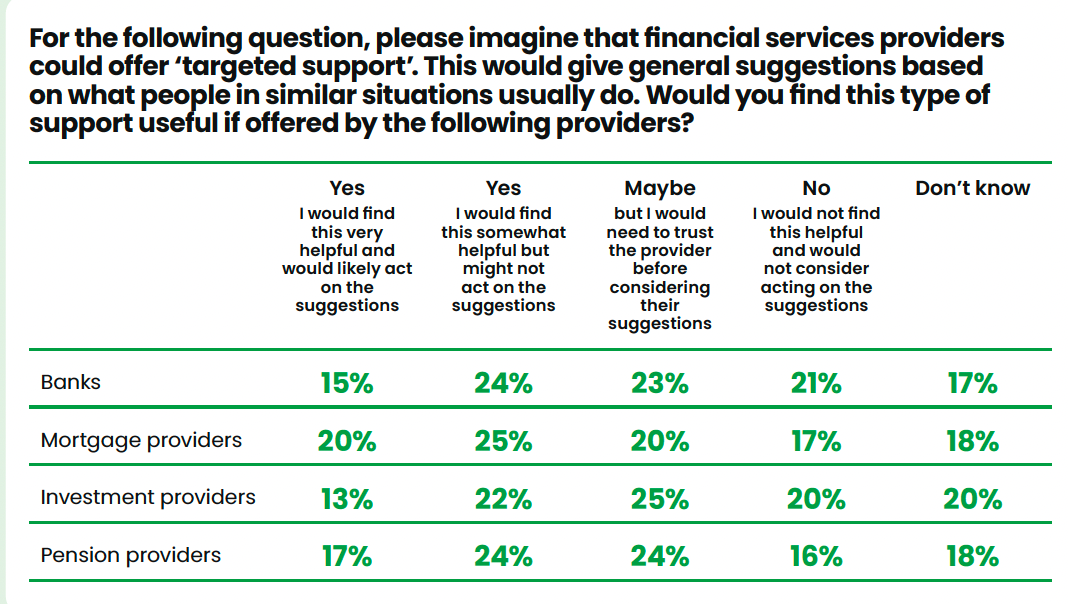

The FCA’s work on the advice guidance boundary review aims to provide a new framework for getting more financial support to more people. Ahead of its findings, we asked consumers what they made of proposals such as targeted support, and talked to advice professionals about three big levers to start tackling the advice gap: regulation, technology and recruitment.

Consumer research

Our research suggests consumers are yet to be convinced about the value of targeted support services, though 17% of respondents say they would find this helpful and would likely act on the suggestions where the information comes from their pension provider. For providers overall, having a strong brand reputation when delivering targeted support will be key.

The value of advice is a recurring theme in the report – but addressing the advice gap is also a question about the perceived value of advice. We’ve established that those who don’t pay for advice don’t see the value, but there is plenty of value for those who have experienced advice for themselves. Among the consumers we heard from, 91% say they found advice helpful.

Adviser research

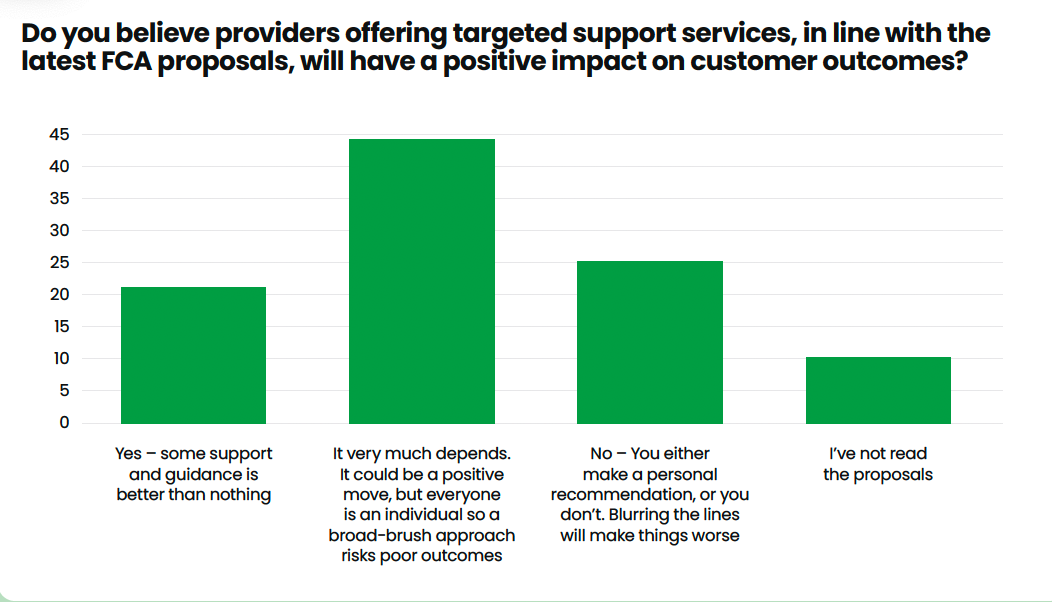

Advice professionals feel that targeted support may go some way to helping consumers, but we also heard from a sizeable number of respondents who fear the proposals could lead to poor outcomes.

Elsewhere advisers told us they believed technology could have a role to play in making it easier to ‘incubate’ clients with straightforward needs, allowing an adviser relationship to be retained as and when the client’s circumstances change.

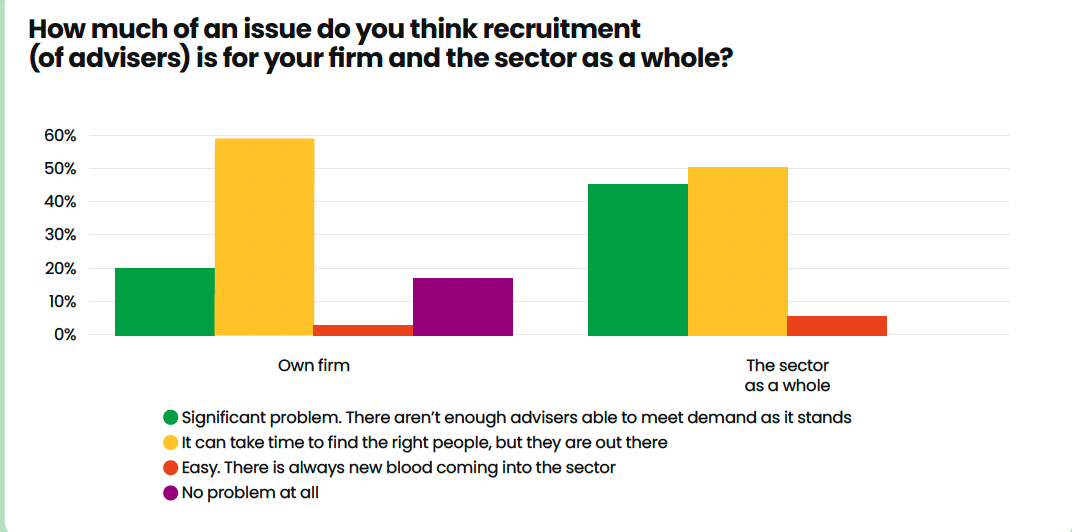

Part of the challenge is ensuring there are enough people to deliver advice in the first place. While only 20% of respondents believe recruitment is a significant problem for their firm, 44% say it is one for the wider sector.

As one advice professional acknowledged, it is difficult to find a route in, but funding the required training is difficult too. This is an issue we at the lang cat plan on returning to very soon.

Get the report now!

Download the report for free thanks to the generosity of our sponsors: AJ Bell Touch, Just Group, Quilter and Royal London.